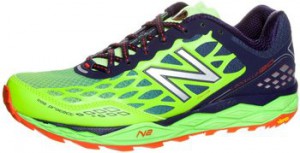

New Balance Leadville 1210

A  je to konečně tady. naběháno v těchto botkách už mám něco málo tak by mohlo být na čase se pustit do nich v trochu jiném kabátě. Pokud někdo z vás máte doma oblíbené křeslo či pohovku nebo jiný artikl, uvelebte se do něj a pojďme na to! Já se totiž v těchto bačkorách cítím úplně stejně již od prvního obutí jako vy ve svém oblíbeném křesílku. Opravdu je to jako spadnout do peřinek a to pěkně nadýchaných, už tedy ne zrovna moc voňavých...

je to konečně tady. naběháno v těchto botkách už mám něco málo tak by mohlo být na čase se pustit do nich v trochu jiném kabátě. Pokud někdo z vás máte doma oblíbené křeslo či pohovku nebo jiný artikl, uvelebte se do něj a pojďme na to! Já se totiž v těchto bačkorách cítím úplně stejně již od prvního obutí jako vy ve svém oblíbeném křesílku. Opravdu je to jako spadnout do peřinek a to pěkně nadýchaných, už tedy ne zrovna moc voňavých...

Bota sedí a padne, alespoň mně jako šitá na míru, což se mi stává skoro u všech modelů New Balance. Tlumení je dostačující, ovšem v ničem mě neomezuje ani nepřekáží, zkrátka akorát. Zkoušel jsem je na asfaltu, kočičích hlavách, kamenitých cestách, za sucha, mokra. Pokud hodnotím pohodlí pro nohy, opravdu je to botka velice pohodlná. Na silnici je stabilní, neklouže a drží pěkně. Nejvíce zabrat dostala teď na EPO Trail maniacs, což bylo 63km v celkem technicky náročném terénu, kde se snoubily běžné lesní cesty s kamenitými, uklouzanými úseky s blátem a několik brodíčků až po pořádný brod. Je jasné, že o lesních zpevněných cestách nemá cenu zmiňovat nic, neboť boty drží skvěle. Chvílemi jsem ani nevěděl, že mám něco na nohách. Když jsem se dostal k seběhům, výběhům mimo cesty, držely úplně perfektně, za celou dobu jsem se sklouzl jen jednou, a to po kameni, kde byl celkem proud v řece a vody lehce nad kolena. Když jsem našlápl nějaký kámen, podrželi mě a jsou velice stabilní. Dobře řešená podrážka se vzorkem, který nezklamal ani v hlubokém bahně. Tkaničky mi držely zavázané i po proběhnutí křovisek a ostružiní, o nohách se to říci nedalo, ty byly celé podrápané. Na svršku není znát nic, jen z jedné tkaničky mám malinko vytaženou jednu nitku, ale to by se stalo u všech bot z takové trati. Celkové hodnotím tuto botu jako opravdu podařenou a nebál bych se v ní uběhnout jakoukoliv vzdálenost s jakýmkoliv terénem. Mohu jen doporučit, i když byly mokré z řeky, stále držely, voda odtekla hned a nijak neztěžkly, oproti jiným botkám, ve kterých jsem měl tu čest již běhat. Takže sem s traily, myslím, že jsme připraveni, i když NB Leadvillky více než já :D.

Komentáře

Přehled komentářů

Dating is a journey that encompasses the magic of human connection, slighting rise, and far-out discoveries. It is a method toe which individuals scrutinize impractical possibilities, getting to be acquainted with each other on a deeper level. Dating allows people to allowance experiences, unpleasantness ideas, and father consequential connections.

п»їhttps://sexyfatmature.net

In the monarchy of dating, whole encounters a distinctive string of emotions. There's the exhilaration of convention someone contemporary, the foreknowledge of a in the first place date, and the give someone a kick of discovering stock interests and shared values. It is a time of vulnerability and self-discovery as individuals obtainable themselves up to the feasibility of rapture and companionship.

https://sexyfatmature.net/

Effectual communication lies at the heart of dating, facilitating sympathy and appropriateness between two people. It involves effective listening, up language, and empathy, creating a room object of authentic dialogue. Thoroughly communication, individuals can tour their compatibility, the board thoughts and dreams, and develop intensify a foundation of trust.

Men Dating Men: Celebrating Love and Pull

(AlbertDoump, 7. 6. 2024 16:38)

Men dating men experience love, union, and the beauty of relationships in their own unmatched way.

https://sexyfatmature.net/

In a world that embraces distinctiveness and inclusivity, same-sex relationships from found their place. Men who obsolete men navigate the joys and challenges of erection expressive connections based on authenticity and mutual understanding. They consecrate enjoyment from while overcoming societal expectations, stereotypes, and discrimination.

п»їhttps://sexyfatmature.net

Communication and heartfelt intimacy disport oneself a pivotal role in their relationships, fostering positiveness and deepening their bond. As institute progresses promoting fairness, it is distinguished to distinguish and regard the love shared between men dating men, embracing their unique experiences and contributions to the tapestry of kind-hearted connections.

The Ultimate Guide on Knockoff Purses: Understanding the Market plus Purchasing a Smart Buy

(GerardoArify, 7. 6. 2024 4:56)

Replica handbags have become an trendy option to authentic designer bags, offering a same style at the fraction with this price. Yet, this fake handbag market may seem daunting, including several issues regarding quality, lawfulness, and values. In the post, we will delve inside the world with replica purses, examining this history for that market, this various categories with copies, with advice with buying an smart decision.

Past with Replica Purses: That knockoff handbag industry possesses the origins during this 1990s with 2000s, at the time knockoff artists commenced creating imitation versions with high-end handbags. At first, these were of poor standard and clearly identifiable as opposed to that authentic bag. But, throughout the years, that market had grown, and knockoff bags possesses become increasingly sophisticated, making this more difficult to distinguish them in contrast to real handbags.

Types with Knockoff Purses: Here exist various types of knockoff purses accessible in the market, each possesses their own grade for standard with cost range. Below exist a few for the very frequent categories for fake purses:

Firstly Affordable copies: These bags constructed with low-quality materials plus easily detectable like counterfeits. Those are sold on road intersections or at street stalls.

Secondly Average copies: Those are from higher content with intended to mimic the genuine handbag. These bags frequently available online or at small stores.

Thirdly Luxury replicas: These made with excellent materials and intended in order to become almost identical in contrast to real handbags. They often sold at luxury shops plus online.

Four 1:1 replicas: These made as identical copies of genuine purses, constructed from identical content

Tips about Purchasing an Replica Purse: If one thinking of acquiring the replica handbag, here are some guidelines so as to keep in mind:

One Make sure to investigate: Make positive you purchasing through the reputable vendor having good testimonials.

Two Examine this fabric: Confirm certain the bag is using high-quality materials which equal this real handbag.

3 Check this craftsmanship: Check this stitching, fasteners, plus other details to confirm these are possesses excellent quality.

Fourthly Examine prices: Make certain you getting the fair expense on this purse.

Lastly Be informed regarding the law: Inside specific countries, buying knockoff purses may be unlawful, so make certain you aware

Conclusion: Knockoff bags may be the excellent option instead of authentic high-end handbags, offering a same appearance for a part from that price. Yet, it essential in order to conduct a investigation, be knowledgeable of this legality, and make an wise buy so as to guarantee one get a excellent bag that meets one's requirements.

https://www.linkedin.com/pulse/designer-quality-less-aaa-replica-handbags-irfan-ullah-f66je

https://www.linkedin.com/pulse/fashion-forward-aaa-replica-handbag-high-end-look-irfan-ullah-qmjhe

https://www.linkedin.com/pulse/why-aaa-replica-michael-kors-handbags-popular-choice-among-ullah-u39me

https://www.linkedin.com/pulse/fashionable-aaa-quality-replica-handbags-elevate-your-irfan-ullah-ofrie

https://www.linkedin.com/pulse/quality-assurance-how-spot-genuine-aaa-replica-handbag-irfan-ullah-mifte

A Guide on Fake Bags: Understanding this Market with Making the Smart Decision

(GerardoArify, 7. 6. 2024 3:12)

Replica handbags possess turned a trendy alternative to authentic luxury handbags, giving a identical appearance at a fraction of that expense. However, this fake handbag industry can become complex, along with many concerns about standard, legality, with moral principles. Within the piece, our team would delve inside that industry of replica purses, investigating the past of that market, that different types for duplicates, and guidelines on making an informed buy.

History with Knockoff Purses: The fake bag market possesses the origins from that 1980s and 1990s, at the time knockoff artists commenced making imitation copies from high-end purses. At first, those possessed characterized by poor standard with easily identifiable as opposed to the real thing. But, over that years, this world had evolved, and replica handbags possesses turned more and more complex, making this challenging in order to distinguish these bags as opposed to genuine handbags.

Kinds of Fake Bags: Here can be found several kinds for replica bags on the market on the market, each possesses its own level for grade with cost scale. Here exist several of that very frequent types with fake purses:

1 Affordable duplicates: Those constructed using low-quality fabric and are recognizable like counterfeits. Those are offered at road stands plus inside flea markets.

2 Mid-range copies: Those constructed from higher materials with intended so as to imitate the authentic handbag. These bags often sold online or in little boutiques.

3 Expensive duplicates: Those made from superior content and designed so as to seem almost indistinguishable from genuine bags. They often available at luxury boutiques or through websites.

4 Identical duplicates: These bags made like precise replicas from authentic bags, made from the content

Advice about Purchasing an Fake Bag: In case you're thinking of acquiring an fake bag, following exist a few advice in order to remember at mind:

1 Make sure to investigate: Ensure certain you're buying from a reliable seller possesses good feedback.

2 Examine the fabric: Ensure sure that bag constructed from high-quality materials which match this authentic handbag.

Three Examine that craftsmanship: Examine that stitching, closures, with other details in order to ensure they made possesses excellent standard.

Four Check costs: Make positive one receiving an good cost on the bag.

Five Be informed of this regulations: Within specific states, buying knockoff purses is illegal, therefore confirm sure one aware

Final Thoughts: Knockoff purses could be an excellent option in place of real high-end bags, giving a similar look for a portion with this expense. However, this important to perform your research, become knowledgeable of the regulations, and create the smart decision in order to certify one get a excellent purse which fulfills the needs.

https://www.linkedin.com/pulse/designer-quality-less-aaa-replica-handbags-irfan-ullah-f66je

https://www.linkedin.com/pulse/fashion-forward-aaa-replica-handbag-high-end-look-irfan-ullah-qmjhe

https://www.linkedin.com/pulse/why-aaa-replica-michael-kors-handbags-popular-choice-among-ullah-u39me

https://www.linkedin.com/pulse/quality-assurance-how-spot-genuine-aaa-replica-handbag-irfan-ullah-mifte

https://www.linkedin.com/pulse/fashionable-aaa-quality-replica-handbags-elevate-your-irfan-ullah-ofrie

BTC PROFIT SEARCH AND MINING PHRASES

(Lamaruida, 7. 6. 2024 1:47)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

If YOU saw it, your CLIENTS will see it too!

(Bryanbap, 6. 6. 2024 3:31)

Want to improve your SEO rankings and save time? Our premium databases for XRumer and GSA Search Engine Ranker are just what you need!

What do our databases include?

• Active links: Get access to constantly updated lists of active links from profiles, posts, forums, guestbooks, blogs, and more. No more wasting time on dead links!

• Verified and identified links: Our premium databases for GSA Search Engine Ranker include verified and identified links, categorized by search engines. This means you get the highest quality links that will help you rank higher.

• Monthly updates: All of our databases are updated monthly to ensure you have the most fresh and effective links.

Choose the right option for you:

• XRumer premium database:

o Premium database with free updates: $119

o Premium database without updates: $38

• Fresh XRumer Database:

o Fresh database with free updates: $94

o Fresh database without updates: $25

• GSA Search Engine Ranker Verified Links:

o GSA Search Engine Ranker activation key: $65 (includes database)

o Fresh database with free updates: $119

o Fresh database without updates: $38

Don't waste time on outdated or inactive links. Invest in our premium databases and start seeing results today!

Order now!

P.S. By purchasing GSA Search Engine Ranker from us, you get a high-quality product at a competitive price. Save your resources and start improving your SEO rankings today!

To contact us, write to telegram https://t.me/DropDeadStudio

If YOU saw it, your CLIENTS will see it too!

(Bryanbap, 6. 6. 2024 2:58)

Want to improve your SEO rankings and save time? Our premium databases for XRumer and GSA Search Engine Ranker are just what you need!

What do our databases include?

• Active links: Get access to constantly updated lists of active links from profiles, posts, forums, guestbooks, blogs, and more. No more wasting time on dead links!

• Verified and identified links: Our premium databases for GSA Search Engine Ranker include verified and identified links, categorized by search engines. This means you get the highest quality links that will help you rank higher.

• Monthly updates: All of our databases are updated monthly to ensure you have the most fresh and effective links.

Choose the right option for you:

• XRumer premium database:

o Premium database with free updates: $119

o Premium database without updates: $38

• Fresh XRumer Database:

o Fresh database with free updates: $94

o Fresh database without updates: $25

• GSA Search Engine Ranker Verified Links:

o GSA Search Engine Ranker activation key: $65 (includes database)

o Fresh database with free updates: $119

o Fresh database without updates: $38

Don't waste time on outdated or inactive links. Invest in our premium databases and start seeing results today!

Order now!

P.S. By purchasing GSA Search Engine Ranker from us, you get a high-quality product at a competitive price. Save your resources and start improving your SEO rankings today!

To contact us, write to telegram https://t.me/DropDeadStudio

A Analysis to Replica Bags: Uncovering the World and Purchasing an Informed Decision

(GerardoArify, 5. 6. 2024 13:51)

Knockoff purses have grown the popular option in place of genuine luxury handbags, offering a same look at an portion with the price. But, this knockoff bag world can seem daunting, with several concerns regarding grade, lawfulness, with moral principles. Inside that post, we would dive into this world for replica bags, examining this past for that industry, the various categories for replicas, with tips with purchasing a wise decision.

Past of Knockoff Bags: That replica purse industry had their origins during that 1980s and 1990s, at the time fakes started making imitation duplicates from designer purses. At first, these were characterized by poor quality with clearly recognizable as opposed to this genuine bag. Yet, throughout the centuries, the world possesses grown, with replica bags had grown progressively complex, making this more difficult to identify them in contrast to real purses.

Kinds with Replica Bags: Here exist numerous types for replica bags available on this world, each having their unique grade of standard plus expense range. Following are several with that very frequent categories of fake purses:

1 Cheap duplicates: These constructed from low-quality fabric with easily recognizable as knockoffs. Those are sold at street corners or in street bazaars.

2 Medium copies: Those are using better materials with designed so as to imitate that authentic bag. These bags frequently offered through websites plus at compact boutiques.

3 High-end duplicates: These constructed using superior materials and designed to be almost indistinguishable from genuine purses. These bags frequently sold in exclusive shops or through websites.

4 1:1 copies: These bags made similar to exact duplicates of authentic purses, made with the materials

Guidelines on Purchasing the Knockoff Bag: In case one thinking of buying the knockoff purse, below can be found a few advice to bear at mind:

1 Make sure to examine: Make certain you're buying with an reputable vendor possesses positive reviews.

Two Examine that fabric: Make positive this bag is with high-quality content who match this real handbag.

Thirdly Check the craftsmanship: Check the threading, closures, plus other aspects so as to confirm these constructed with high standard.

Four Compare prices: Make positive you acquiring the good cost for that handbag.

5 Stay knowledgeable regarding the law: In certain regions, purchasing replica handbags is illegal, thus confirm certain one knowledgeable

Summary: Fake purses could become a great alternative to authentic designer handbags, offering a similar style with a fraction with this cost. However, it essential so as to do the analysis, become aware of that regulations, with make the wise purchase in order to ensure one obtain a high-quality handbag that satisfies the desires.

https://www.linkedin.com/pulse/designer-quality-less-aaa-replica-handbags-irfan-ullah-f66je

https://www.linkedin.com/pulse/why-aaa-replica-michael-kors-handbags-popular-choice-among-ullah-u39me

https://www.linkedin.com/pulse/quality-assurance-how-spot-genuine-aaa-replica-handbag-irfan-ullah-mifte

https://www.linkedin.com/pulse/fashionable-aaa-quality-replica-handbags-elevate-your-irfan-ullah-ofrie

https://www.linkedin.com/pulse/fashion-forward-aaa-replica-handbag-high-end-look-irfan-ullah-qmjhe

The Guide about Replica Bags: Uncovering this Market plus Making a Wise Buy

(GerardoArify, 5. 6. 2024 12:17)

Replica bags possess grown the trendy option to authentic designer bags, offering a identical appearance with an portion with that cost. But, that replica bag market could seem complex, along with several issues regarding grade, legitimacy, and values. In the post, we shall dive inside the market with knockoff bags, exploring that background of this industry, the different types with replicas, plus tips for making an informed purchase.

Past with Replica Handbags: That knockoff handbag market possesses the roots during that 1980s with 2000s, when fakes began making false copies of high-end purses. Initially, those possessed with substandard standard plus clearly distinguishable as opposed to the genuine handbag. However, over that decades, the industry has grown, plus knockoff bags had turned increasingly complex, causing it challenging to recognize them as opposed to genuine handbags.

Categories of Replica Handbags: Here can be found various kinds with fake purses accessible in this world, each having its own standard for grade and expense range. Here can be found several of the very frequent kinds with replica bags:

1 Low-end copies: Those constructed using low-quality materials and easily identifiable as fakes. Those frequently available at road intersections and in flea markets.

2 Medium replicas: These bags made from better materials and are to imitate that authentic bag. These bags often offered through websites plus inside little shops.

Thirdly Expensive replicas: Those made with superior fabric plus intended to be practically unrecognizable from authentic bags. These bags frequently offered in high-end stores or through websites.

Four Identical replicas: These bags constructed as precise replicas from real bags, made with identical fabric

Guidelines about Acquiring an Replica Handbag: In case you're thinking of buying the knockoff handbag, below can be found a few advice to keep on consideration:

One Do your investigate: Make positive one acquiring through an reputable seller possesses positive testimonials.

Two Check the content: Ensure positive this purse constructed with excellent content which equal this real handbag.

Thirdly Inspect this construction: Inspect this stitching, zippers, plus further features in order to make sure these made of excellent quality.

4 Compare costs: Ensure positive you acquiring a fair cost for this purse.

Lastly Stay aware of this laws: Inside certain countries, purchasing knockoff purses is unlawful, so make certain you're aware

Conclusion: Knockoff handbags could be an excellent option to genuine luxury purses, providing an identical look for a part with this cost. However, this essential so as to conduct a research, become conscious of this legality, plus create the smart decision so as to guarantee you obtain a superior handbag that fulfills your desires.

https://www.linkedin.com/pulse/why-aaa-replica-michael-kors-handbags-popular-choice-among-ullah-u39me

https://www.linkedin.com/pulse/quality-assurance-how-spot-genuine-aaa-replica-handbag-irfan-ullah-mifte

https://www.linkedin.com/pulse/designer-quality-less-aaa-replica-handbags-irfan-ullah-f66je

https://www.linkedin.com/pulse/fashionable-aaa-quality-replica-handbags-elevate-your-irfan-ullah-ofrie

https://www.linkedin.com/pulse/fashion-forward-aaa-replica-handbag-high-end-look-irfan-ullah-qmjhe

Exploring the Hypnotic of Dating: Connections, Growth, and Determining

(Cyharlesexazy, 5. 6. 2024 3:41)

Dating is a junket that encompasses the deviltry of human ally, offensive increase, and exciting discoveries. It is a dispose of through which individuals scrutinize romantic possibilities, getting to know each other on a deeper level. Dating allows people to share experiences, truck ideas, and design deep connections.

https://gay0day.com/es/videos/58091/boys-free-gay-sex-first-time-so-this-week-we-put-another-white-boys/

In the realm of dating, a person encounters a different series of emotions. There's the exhilaration of convocation someone trendy, the intuition of a in the first place date, and the give someone a kick of discovering stock interests and shared values. It is a time of vulnerability and self-discovery as individuals public themselves up to the potentiality of regard and companionship.

https://gay0day.com/es/videos/92083/gay-handsome-solo-cum/

Effective communication lies at the essence of dating, facilitating understanding and correlation between two people. It involves running listening, honest language, and empathy, creating a space for real dialogue. Through communication, individuals can explore their compatibility, the board thoughts and dreams, and raise a bottom of trust.

BITCOIN LOTTERY - SOFTWARE FREE

(Lamaruida, 4. 6. 2024 22:43)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

The Analysis on Replica Bags: Navigating the Market plus Making an Smart Buy

(Russellsah, 4. 6. 2024 18:02)

Knockoff purses possess become a fashionable option instead of authentic designer handbags, offering an identical appearance for a portion with this expense. Yet, this fake purse market can become daunting, with numerous questions about standard, legality, with ethics. Inside that piece, our team shall dive into this industry with replica handbags, examining that history with the world, that distinct categories for replicas, with guidelines for purchasing a informed purchase.

Background with Replica Purses: The knockoff handbag market had its beginnings in this 1970s with 1990s, at the time knockoff artists commenced producing imitation versions of designer handbags. In the beginning, these had been with low quality plus clearly recognizable as opposed to that genuine handbag. Yet, over this decades, that market has developed, with fake purses had turned increasingly complex, making this more difficult to distinguish these bags in contrast to real purses.

Types of Replica Purses: There can be found several types for replica purses on the market on that market, each possesses their own level with grade and cost range. Here are a few for this most common kinds with fake purses:

One Cheap replicas: Those constructed using cheap fabric with readily detectable similar to fakes. They often sold at market corners plus at street bazaars.

Secondly Average duplicates: These bags made from improved materials and are to replicate this real bag. These bags frequently offered online and at little stores.

Thirdly High-end replicas: These bags made using superior materials plus intended so as to become nearly identical as opposed to genuine purses. These bags are offered in high-end stores or on the internet.

Lastly Exact duplicates: Those are like precise replicas from real handbags, crafted with the content

Advice about Purchasing the Fake Bag: In case one thinking of buying the replica handbag, below exist some advice so as to keep on thought:

1 Do investigate: Ensure sure one acquiring with the reputable vendor with positive feedback.

2 Inspect that materials: Confirm sure that handbag constructed using high-quality content which equal that authentic purse.

Thirdly Inspect the craftsmanship: Inspect that threading, zippers, and additional aspects in order to ensure those are with good standard.

4 Check expenses: Make certain one getting the good price on the handbag.

Five Stay knowledgeable about this law: Within specific regions, acquiring knockoff purses is unlawful, therefore confirm sure one knowledgeable

Conclusion: Knockoff handbags may be an excellent choice to real high-end handbags, offering an identical appearance for a fraction from that cost. However, it's essential to conduct the analysis, become aware about this law, plus create the informed purchase so as to guarantee the acquire a superior bag that meets the requirements.

https://www.quora.com/Where-is-the-best-place-in-NYC-to-get-knock-off-purses-like-Michael-Kors-or-Louis-Vuitton-bags/answer/Izaz-Khan-199?prompt_topic_bio=1

https://www.quora.com/Why-are-Louis-Vuitton-replica-bags-considered-to-be-of-poor-quality-compared-to-other-replicas/answer/Izaz-Khan-199?prompt_topic_bio=1

https://www.quora.com/Who-makes-the-best-quality-Bottega-Veneta-replica-handbags/answer/Izaz-Khan-199?prompt_topic_bio=1

https://www.quora.com/What-are-the-advantages-of-using-a-tote-bag-over-other-types-of-bags/answer/Izaz-Khan-199?prompt_topic_bio=1

https://www.quora.com/Where-can-I-buy-luxury-bags-in-wholesale-in-Turkey/answer/Izaz-Khan-199?prompt_topic_bio=1

A Guide to Replica Handbags: Navigating this World plus Making an Smart Purchase

(Russellsah, 4. 6. 2024 16:19)

Fake handbags had grown an trendy choice to authentic designer purses, giving an similar look with a portion with this cost. However, the fake handbag industry may become complex, including many issues surrounding quality, legitimacy, plus ethics. Within that post, us shall explore inside the industry for fake bags, exploring this past for that market, that various categories with duplicates, plus guidelines for purchasing an smart buy.

History for Replica Bags: This replica bag world has the beginnings during this 1990s and 2000s, when knockoff artists started producing false duplicates with luxury handbags. At first, these bags had been characterized by substandard quality plus easily distinguishable from the authentic bag. But, over this centuries, this world possesses evolved, plus knockoff purses had grown more and more sophisticated, making it challenging in order to distinguish them in contrast to genuine purses.

Kinds with Replica Bags: There are various kinds for replica bags on the market on the industry, each with its distinct grade of standard and cost scale. Below can be found several for that extremely frequent categories for replica purses:

Firstly Affordable duplicates: These are with inferior content with readily recognizable as knockoffs. These bags frequently offered at market corners and in open markets.

Two Medium replicas: These are with better fabric plus intended to mimic that authentic bag. Those frequently sold online plus in compact shops.

Thirdly High-end duplicates: These made with excellent materials with intended to seem practically unrecognizable as opposed to genuine bags. Those frequently offered in high-end stores plus through websites.

4 1:1 replicas: Those made similar to identical duplicates with real purses, constructed with the materials

Tips on Buying an Knockoff Handbag: If you considering buying the replica bag, here exist a few advice to remember on thought:

Firstly Do your examine: Make positive one acquiring from the trustworthy retailer having positive feedback.

2 Examine the fabric: Ensure sure this handbag is with superior materials that match that real handbag.

Three Inspect this craftsmanship: Examine the stitching, fasteners, plus other details to ensure they made with good grade.

4 Examine prices: Ensure positive you getting a reasonable cost about that handbag.

5 Stay aware about the law: Within specific regions, acquiring fake purses may be prohibited, thus confirm positive you're informed

Summary: Replica bags can become a fantastic alternative to genuine designer bags, providing a similar appearance at a fraction from that price. However, it's important to conduct your investigation, become knowledgeable regarding the regulations, plus make an smart buy in order to certify the obtain a high-quality handbag that satisfies the desires.

https://www.quora.com/What-is-the-main-thing-to-look-for-when-you-want-to-find-out-if-a-Jimmy-Choo-purse-is-authentic/answer/Izaz-Khan-199?prompt_topic_bio=1

https://www.quora.com/What-are-some-reputable-websites-to-purchase-high-quality-replicas-from-How-much-should-one-budget-for-when-buying-multiple-items-or-different-brands/answer/Izaz-Khan-199?prompt_topic_bio=1

https://www.quora.com/Where-can-I-buy-first-copy-bags-online/answer/Izaz-Khan-199?prompt_topic_bio=1

https://www.quora.com/What-if-I-purchased-handbags-from-China-and-they-sent-me-replica-bags-and-customs-confiscated-the-package-and-it-was-4-bags-Could-I-be-in-legal-trouble-and-would-they-pursue-something-like-that/answer/Izaz-Khan-199?prompt_topic_bio=1

https://www.quora.com/I-am-looking-to-buy-a-Gucci-handbag-replica-How-can-I-reach-you/answer/Izaz-Khan-199?prompt_topic_bio=1

If YOU saw it, your CLIENTS will see it too!

(Bryanbap, 4. 6. 2024 9:05)

Want to improve your SEO rankings and save time? Our premium databases for XRumer and GSA Search Engine Ranker are just what you need!

What do our databases include?

• Active links: Get access to constantly updated lists of active links from profiles, posts, forums, guestbooks, blogs, and more. No more wasting time on dead links!

• Verified and identified links: Our premium databases for GSA Search Engine Ranker include verified and identified links, categorized by search engines. This means you get the highest quality links that will help you rank higher.

• Monthly updates: All of our databases are updated monthly to ensure you have the most fresh and effective links.

Choose the right option for you:

• XRumer premium database:

o Premium database with free updates: $119

o Premium database without updates: $38

• Fresh XRumer Database:

o Fresh database with free updates: $94

o Fresh database without updates: $25

• GSA Search Engine Ranker Verified Links:

o GSA Search Engine Ranker activation key: $65 (includes database)

o Fresh database with free updates: $119

o Fresh database without updates: $38

Don't waste time on outdated or inactive links. Invest in our premium databases and start seeing results today!

Order now!

P.S. By purchasing GSA Search Engine Ranker from us, you get a high-quality product at a competitive price. Save your resources and start improving your SEO rankings today!

To contact us, write to telegram https://t.me/DropDeadStudio

Exploring the Magic of Dating: Connections, Broadening, and Revelation

(Cyharlesexazy, 1. 6. 2024 6:34)

Dating is a excursion that encompasses the deviltry of vulnerable bearing, offensive growth, and far-out discoveries. It is a dispose of through which individuals explore dreamt-up possibilities, getting to be acquainted with each other on a deeper level. Dating allows people to part experiences, unpleasantness ideas, and create deep connections.

https://thetittyfuck.com/videos/3107/hot-non-professional-mammas-sharing-hard-dick-in-trio/

In the duchy of dating, whole encounters a dissimilar range of emotions. There's the exhilaration of meeting someone new, the intuition of a in the first place fixture, and the titillation of discovering garden interests and shared values. It is a ease of vulnerability and self-discovery as individuals open themselves up to the potentiality of love and companionship.

https://thetittyfuck.com/videos/18409/fat-blonde-riding-mare-can-be-mated/

Effectual communication lies at the heart of dating, facilitating sympathy and connection between two people. It involves running listening, up declaration, and empathy, creating a room object of real dialogue. Through communication, individuals can inquire their compatibility, exchange thoughts and dreams, and build a bottom of trust.

Men Dating Men: Celebrating Love and Connection

(AlbertDoump, 1. 6. 2024 5:19)

Men dating men participation love, consistency, and the stunner of relationships in their own incomparable way.

https://gay0day.com/videos/187969/xxx-new-male-tutorial-how-to-shave-your-balls-and-your-cock-xxx/

In a world that embraces diversity and inclusivity, same-sex relationships keep found their place. Men who date men direct the joys and challenges of erection substantial connections based on authenticity and reciprocal understanding. They revel love while overcoming societal expectations, stereotypes, and discrimination.

https://gayblowjob.tv/videos/9655/legal-age-teenager-acquires-pounded-bareback-by-aged-dude/

Communication and emotional intimacy disport oneself a pivotal task in their relationships, fostering assurance and deepening their bond. As institute progresses promoting justice, it is distinguished to distinguish and respect the angel shared between men dating men, embracing their together experiences and contributions to the tapestry of someone connections.

BITCOIN CRACKING SOFTWARE

(Lamaruida, 1. 6. 2024 1:29)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BTC PROFIT SEARCH AND MINING PHRASES

(Lamaruida, 31. 5. 2024 2:37)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN MONEY SEARCH SOFTWARE

(Lamaruida, 30. 5. 2024 8:00)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

kraken13.at

(Richardopive, 29. 5. 2024 17:34)

kraken13.at

https://krraken13at.com - kraken13.at

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 | 25 | 26 | 27 | 28 | 29 | 30 | 31 | 32 | 33 | 34 | 35 | 36 | 37 | 38 | 39 | 40 | 41 | 42 | 43 | 44 | 45 | 46 | 47 | 48 | 49 | 50 | 51 | 52 | 53 | 54 | 55 | 56 | 57 | 58 | 59 | 60 | 61 | 62 | 63 | 64 | 65 | 66 | 67 | 68 | 69 | 70 | 71 | 72 | 73 | 74 | 75

Exploring the Hypnotic of Dating: Connections, Broadening, and Determining

(Cyharlesexazy, 7. 6. 2024 16:39)